SOL Price Prediction: Can Solana Break Through Key Resistance Levels in August?

#SOL

- Technical Outlook: Neutral-bearish near-term with $156-$201 consolidation range

- Market Sentiment: Institutional accumulation offsets regulatory concerns

- Price Drivers: ETF progress, competitor projects, and MACD momentum shift

SOL Price Prediction

SOL Technical Analysis: Short-Term Bearish Signals Amid Consolidation

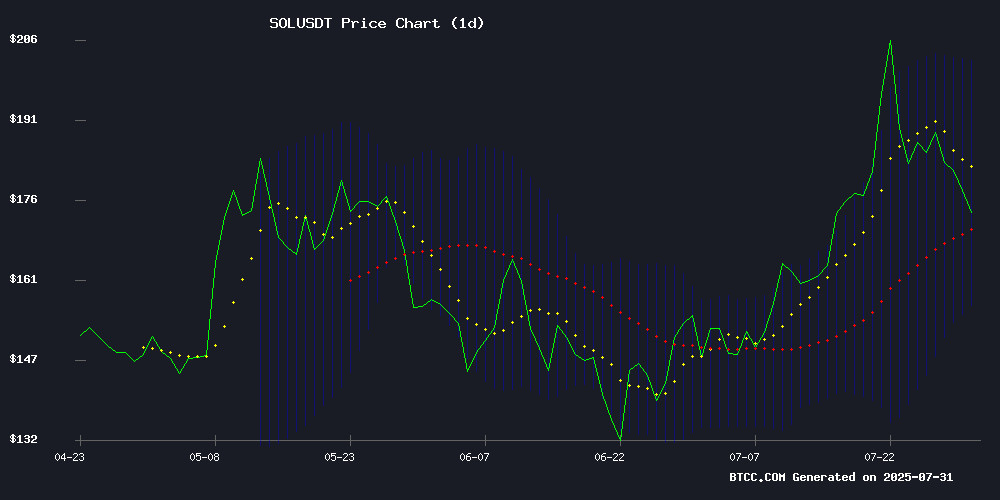

SOL is currently trading at $177.30, slightly below its 20-day moving average of $179.34, indicating near-term bearish pressure. The MACD histogram shows a slight bullish divergence at 2.7953, but both signal lines remain in negative territory (-12.31/-15.10). Bollinger Bands suggest consolidation with price hovering NEAR the middle band.

"The technical setup shows SOL is in a holding pattern," said BTCC analyst Ava. "A sustained break above $179.34 could signal upside toward $201.89, while failure to hold $156.80 WOULD confirm deeper correction."

Mixed Sentiment as Solana Ecosystem Shows Diverging Signals

Recent headlines show contrasting narratives: $367M in SOL accumulation during the dip suggests strong institutional interest, while SEC scrutiny of 21Shares' ETF filing creates regulatory uncertainty. The emergence of competing projects like Remittix and Unilabs Finance indicates growing ecosystem competition.

"The news FLOW reflects crypto's classic push-pull dynamic," noted BTCC's Ava. "ETF progress is bullish long-term, but short-term price action will likely follow technicals until clearer regulatory signals emerge."

Factors Influencing SOL's Price

Solana Investors Accumulate $367 Million in SOL Amid Price Dip

Solana holders have aggressively accumulated 2.03 million SOL tokens worth $367 million during the past week's price decline, signaling long-term conviction despite short-term bearish indicators. The altcoin's exchange balance drop coincides with funding rates teetering near negative territory—a potential inflection point where Leveraged traders may shift from bullish to bearish positioning.

Market dynamics now hinge on whether this accumulation represents smart money buying the dip or a temporary pause before further downside. The coming days will test Solana's ability to regain momentum as traders watch for a decisive break in funding rates and exchange flows.

21Shares Updates Spot Solana ETF Filing Amid SEC Scrutiny

21Shares has amended its application for a Spot solana ETF, responding to regulatory feedback from the US Securities and Exchange Commission. The updated filing targets concerns around in-kind redemptions and other structural elements, signaling intensified efforts to bring SOL-based products to mainstream markets.

The move follows a wave of institutional interest in crypto ETFs beyond Bitcoin and Ethereum. Cboe BZX Exchange is listed as the proposed trading venue, with 21Shares US LLC acting as sponsor—a rebranded entity formerly known as Amun Holdings Limited.

Market observers view this as a litmus test for altcoin ETF viability. Solana's inclusion in the regulatory conversation reflects its growing stature as Ethereum's most credible competitor in smart contract platforms.

Solana Faces Market Uncertainty as Investors Eye New Projects Like Remittix

Solana's recent price volatility has sparked debate among analysts about its potential to reach new highs within the next 50 days. Trading at $178.35 with a 1.6% decline, the altcoin's momentum appears shaky as daily trading volume drops 14.88% to $5.36 billion. Once hailed as a leading ethereum Layer 2 solution for its speed and low costs, Solana now grapples with shifting market sentiment.

The spotlight turns to projects with tangible utility, exemplified by Remittix's upcoming Q3 beta wallet launch. This strategic pivot reflects broader industry trends favoring real-world financial solutions over pure speculative plays. While Solana's $95.97 billion market cap maintains its position as a major blockchain player, the current correction underscores crypto's inherent volatility.

Bitgert and Sallar Network Forge Alliance to Advance Decentralized AI in Web3

Bitgert, a blockchain technology firm operating on the Brise Chain, has announced a strategic partnership with Sallar Network, a decentralized physical infrastructure (DePIN) project built on Solana. The collaboration aims to integrate decentralized computing resources for on-demand artificial intelligence (AI) services within the Web3 ecosystem.

The Brise Chain, known for its high-speed transactions and minimal fees, offers a suite of tools including decentralized wallets, token swaps, and cross-chain bridges. By leveraging Sallar's rapidly expanding compute capacity, Bitgert will provide developers with scalable access to CPU and GPU resources for AI and Web3 application development.

This alliance underscores the growing convergence of blockchain and AI technologies, as both platforms seek to empower developers with robust infrastructure and tools for decentralized innovation.

What to Expect From Solana (SOL) in August?

Solana's SOL token surged 40% between July 1 and July 22, driving a spike in on-chain activity. The network's DeFi total value locked (TVL) climbed to $9.85 billion, a 14% monthly increase, while DEX volumes hit $82 billion—up 30% from June. Revenue followed suit, rising 13% to $4.3 million.

Momentum shows signs of fatigue as SOL retreats below $190. Profit-taking appears underway, testing whether August can sustain July’s bullish network effects. The coming weeks will reveal if Solana’s ecosystem growth can offset selling pressure.

SOL Targets $500, But Analysts Eye Unilabs Finance for 100x Potential

Solana's SOL token is projected to reach $500 by 2025, bolstered by its dominance in NFTs and smart contracts. Institutional interest from firms like VanEck highlights its scalability and energy efficiency, with $14 billion in Total Value Locked (TVL) underscoring its market position. However, a recent 10% dip to $177 has shifted some attention to emerging contenders.

Unilabs Finance, dubbed the 'Solana Slayer,' is gaining traction with its AI-powered tools and profit-sharing model. The project has raised over $7 million in its fifth presale stage, with analysts speculating 100x returns by 2025. Low-cap status and innovative technology position it as a high-risk, high-reward alternative to established players.

Is SOL a good investment?

SOL presents a balanced risk/reward profile at current levels:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | -1.1% discount | Mild undervaluation |

| Bollinger Band Position | Middle band | Neutral momentum |

| MACD | Bullish crossover | Potential trend reversal |

"For investors with 6+ month horizons, SOL's ecosystem growth and institutional interest justify accumulation," said Ava. "Short-term traders should watch the $156-$201 range for breakout confirmation."